Filing your income tax return is essential for all eligible citizens in Pakistan. If your annual income is PKR 600,000 or more, you are required by law to file your tax return.

With the 2022 tax year deadline just around the corner, it’s important to understand the process and submit your return before September 30, 2022.

This guide will walk you through a simple, step-by-step process to help you file your tax return online quickly and easily.

Who Needs to File a Tax Return?

Anyone in Pakistan earning PKR 600,000 or more annually must file an income tax return. If you meet this requirement and haven’t yet filed your return, don’t worry! We’ll guide you through the process.

Being a tax filer also has benefits like tax exemptions and duty waivers, so it’s worth becoming one.

How to File Your Tax Return?

Filing your income tax return is essential for all eligible citizens in Pakistan. Here are the easy steps to file your tax return.

1. Logging into the IRIS Portal

- Visit the Federal Board of Revenue (FBR) website.

- Log into the IRIS portal using your username and password.

- If you forget your password, click on the ‘Forgot password’ option to reset it.

Once you’re logged in:

- Click the ‘Declaration‘ menu.

- Select ‘114(1) Return of Income Filed Voluntarily for 1 Year’.

- Enter the relevant tax year in the Period tab.

2. Employment Section

- Go to the ‘Employment‘ section.

- Click the ‘Salary‘ tab and enter your total annual salary.

- If a portion of your salary is exempt from tax, mention it in the ‘Amount exempt from tax’ field.

- Click ‘Calculate‘ to get your total tax amount.

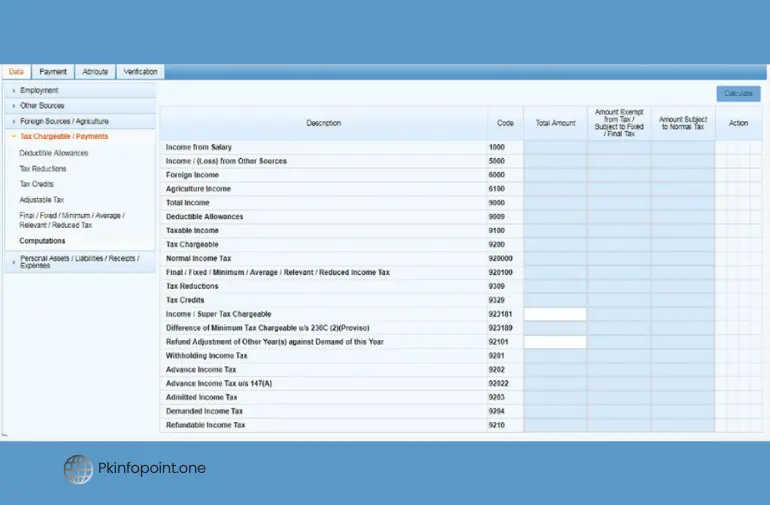

3. Adjustable Tax

- In the ‘Adjustable Tax‘ section, enter details of taxes already paid or deducted throughout the year.

- Go to the ‘Tax Chargeable/Payments‘ tab, and under ‘Deductible Allowances’, enter amounts deducted for Zakat or charitable donations.

- For federal employees, use code 64020001, provincial employees use 64020002, and corporate employees use 64020003 to report their tax deductions.

- You can also adjust taxes deducted by banks, such as on cash withdrawals (code 64100101) or vehicle fees.

4. Tax Payments

- Go to the ‘Tax Chargeable/Payments‘ tab to see details of your income and tax.

- If there’s any tax you owe (under ‘Demanded Income Tax’), make the payment through the National Bank of Pakistan or an authorized payment channel.

- After paying, enter your payment details like the CPR number and amount in the system.

5. Net Assets Section

- Provide details about your assets.

- Enter your previous year’s net assets and the current year’s amount.

- Ensure the ‘Unreconciled Amount’ is zero before submitting.

6. Submitting the Return

- After filling in all the required fields, verify your identity using the PIN given at registration.

- Once verified, click ‘Submit’ to file your tax return.

Now that you know the process, don’t wait! File your tax return before the deadline to avoid penalties and enjoy the benefits of being a tax filer.

Filing your income tax return is an important responsibility, especially if your annual income meets the required threshold. The process is straightforward and can be completed online through the IRIS portal.